Accounting Long Island: Their services free up your time to focus on growing your business

Payroll Services Ny: Acknowledging the Importance of Keeping Accurate Financial Documentation

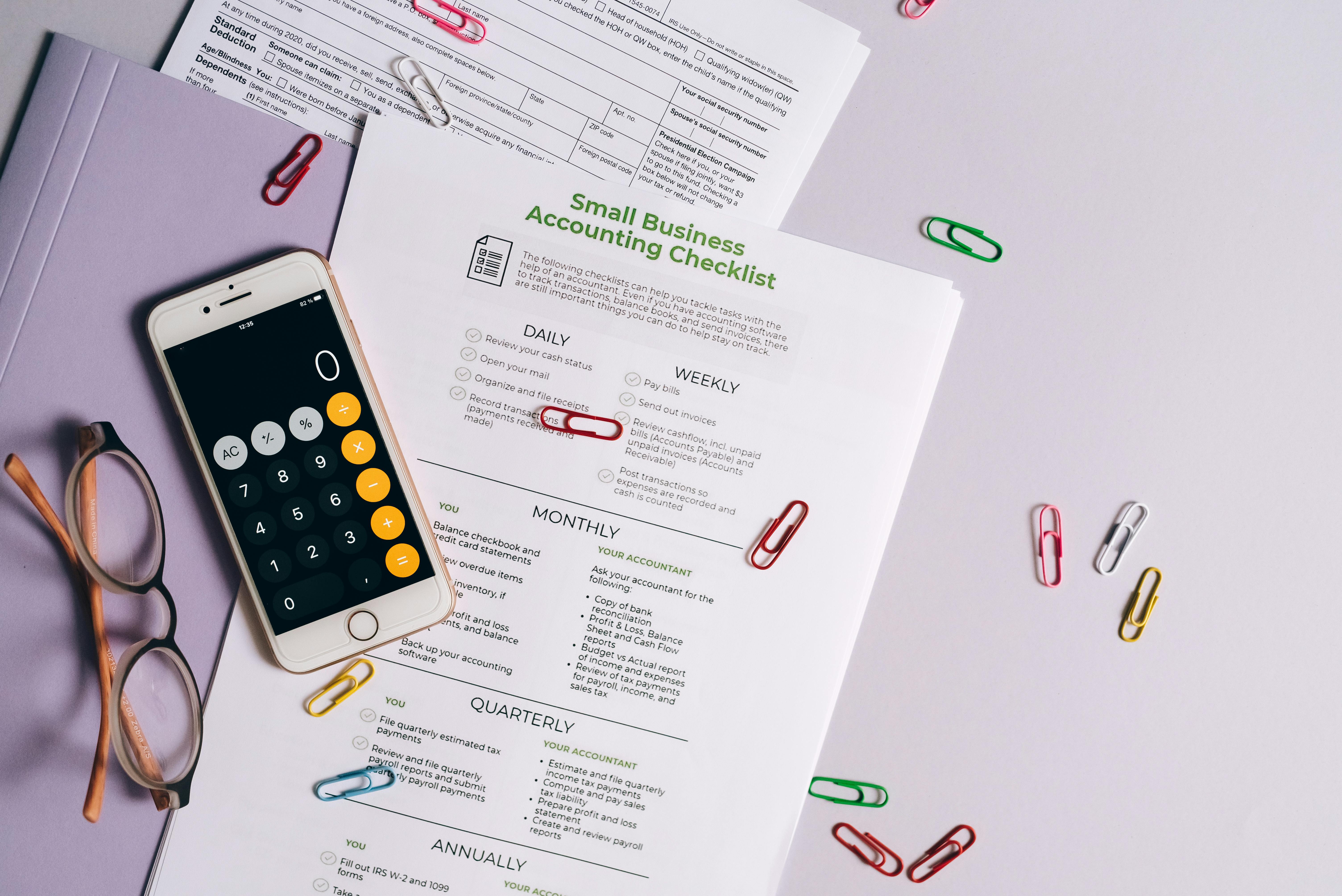

Preserving precise financial records is important for any company, as it lays the groundwork for making notified choices. These records are essential for examining monetary stability, making it possible for companies to with confidence navigate economic unpredictabilities. Additionally, this method encourages openness, helping to cultivate trust among stakeholders and guaranteeing compliance with regulative requirements. Eventually, extensive financial tracking allows people and businesses to plan effectively for future growth and sustainability.

- Keeping financial records enhances the precision of tracking earnings and costs, leading to much better budgeting

- Frequently upgraded records can enhance cash flow management by determining patterns and anticipating requirements

- Quantitative analysis of financial records helps examine profitability and discover potential cost-saving chances

- Keeping precise monetary records is important for adhering to tax laws and can reduce the chances of being investigated

- Evaluating monetary efficiency metrics such as ROI and earnings margins relies greatly on careful record-keeping

Bookkeeping Services USA in Long Island, NY has contributed in organizing my financial records, providing a strong foundation for making notified decisions. Their expertise changed my financial information into vital tools for evaluating financial vigor, allowing me to steer through financial obstacles with assurance. The emphasis on openness not just boosted trust amongst my partners however also guaranteed adherence to all necessary guidelines. Due to their thorough oversight, I website now feel ready to develop efficient strategies that promote long-term development and resilience.

Bookkeeping Sevices USA,2191 Maple St, Wantagh, NY 11793, United States,+15168084834

For more information - Click Here

Key Elements of Professional Accounting Assistance

Professional financial facilitators provide a vast array of essential services that streamline financial management for organizations. Their knowledge includes precise record-keeping, ensuring compliance with regulative frameworks while optimizing tax techniques. They provide important point of views that assist decision-makers in browsing intricate financial landscapes. Making use of advanced software and techniques, these experts enhance the accuracy of monetary reporting, resulting in increased effectiveness and growth for the organization.

- Highlight the significance of keeping exact records to guarantee adherence to policies and maintain monetary stability

- Highlight the significance of comprehending tax regulations and deadlines to avoid penalties

- Highlight the significance of making use of accounting software application to improve processes and increase effectiveness

- Encourage routine financial analysis to identify patterns and make notified company choices

- Continuing education and certification are advised to stay informed about existing market standards and practices

Accounting Services USA has actually totally altered my method to monetary management with their large range of important services that make monetary administration easier for companies. Their knowledge in extensive documentation guarantees compliance with legal requirements while likewise enhancing tax methods effectively. In addition, their informative assessments empower leaders to navigate complex financial landscapes with assurance. By employing advanced technology and imaginative methods, this team considerably improves the accuracy of financial statements, promoting functional effectiveness and growth.

Varieties of Financial Management Options Accessible

Financial management solutions consist of a variety of tools aimed at improving monetary oversight and helping with better decision-making. Alternative accounting specialists typically leverage sophisticated software to improve transactions and balance accounts, consequently improving accuracy. Furthermore, tactical budgeting applications provide companies with the means to assign resources efficiently while forecasting future monetary conditions. Ultimately, accepting these ingenious systems could substantially change the way business handle their monetary operations.

- Financial management options can be divided into categories such as budgeting, forecasting, and reporting tools

- Business Resource Planning (ERP) systems combine financial information from different departments to help with informed decision-making

- Financial management solutions that are cloud-based supply versatility and instant access to monetary data

- Investment management software helps keep an eye on portfolios and assess market patterns to improve possession allowance

- Compliance management tools assist companies stick to financial policies and requirements effectively

Accounting Services USA in Long Island has actually significantly changed the method I manage my finances through their exceptional array of services. Their proficient team uses innovative software that not just automates transactions but likewise diligently balances accounts, raising accuracy to brand-new heights. Additionally, their extensive budgeting tools permit business to effectively disperse resources as they prepare for future financial scenarios. The seamless incorporation of these advanced systems has actually greatly altered the business's monetary management practices.

Secret Considerations for Choosing the Perfect Financial Service Provider

Choosing the best monetary service partner includes a thorough evaluation of their abilities and the variety of services developed to fulfill your particular requirements. Concentrate on applicants who show a deep understanding of your market and possess the essential accreditations that show their expertise. In addition, evaluate their communication design and how rapidly they respond, as these aspects can substantially affect the total experience. In the end, consider how effectively their services can adjust to your developing monetary goals, promoting an effective long-lasting collaboration.

- Advantages consist of access to professional assistance and customized financial solutions created to satisfy unique requirements

- A credible supplier can deliver a variety of services, improving both convenience and effectiveness

- Choosing a well-established service provider might ensure better security and reliability for financial deals

- Cons can include high costs or commissions that may minimize total returns on investments

- Restricted choices from specific service providers could hamper the search for the most suitable service for private monetary goals

Selecting Bookkeeping Services USA in Long Island was a game changer for my financial management. Their extensive understanding of my market, in addition to noteworthy certifications, quickly inspired self-confidence in their capabilities. The group's capacity to interact complex information effectively, along with their speedy reaction times, ensured that the entire process ran smoothly. Furthermore, their capability to adjust services to fit my evolving monetary objectives makes sure that we stay completely in sync as we progress.

Typical Mistakes to Avoid When Managing Finances

A typical error people make in managing their finances is stopping working to monitor their spending carefully, which leads to unexpected shortfalls. Additionally, not developing a budget plan can result in unforeseeable spending patterns, threatening long-term monetary stability. It is a good idea to refrain from relying specifically on credit for everyday expenditures, as this may lead to considerable financial obligation. Lastly, overlooking the significance of emergency situation cost savings can leave one vulnerable during unforeseen circumstances, jeopardizing monetary health.

- Accounting Services USA specializes in developing tailored financial methods developed to resolve the particular requirements of every customer

- They offer comprehensive training on recognizing and avoiding common financial mistakes

- The group offers continuous support and resources to keep clients updated on finest practices

- Business utilizes advanced technology to improve monetary management and decrease errors

- They emphasize the significance of routine monetary reviews to clients in order to avoid mismanagement

Bookkeeping Services USA in Long Island, NY has actually significantly transformed my method to handling financial resources, expertly directing me far from the common mistake of reckless cost tracking that could have caused unexpected shortfalls. Their informative advice on developing a practical budget plan assisted me eliminate erratic costs patterns, leading the way for a more protected financial future. They highlighted the significance of preventing dependence on credit for everyday expenditures, which has helped me avoid the risks of extreme debt. In addition, their focus on the significance of emergency savings has actually enhanced my financial stability, guaranteeing that I am gotten ready for any unexpected difficulties that may happen.

Advantages of Outsourcing Your Financial Tasks

Handing over financial duties can considerably improve functional efficiency by allowing companies to concentrate on their primary activities. Relying on professionals for the complexities of monetary management enables organizations to decrease the threats associated with monetary mistakes and compliance issues. This strategic method not just lowers overhead expenditures but likewise leverages specific competence to improve decision-making. Ultimately, engaging experts in this location results in a more efficient process that promotes sustainable development and flexibility.

Accounting Services USA in Long Island, NY transformed my monetary management strategy, enabling me to focus on what really matters for my company. By entrusting my complex financial tasks to their skilled team, I sidestepped potential problems associated with monetary errors and compliance with guidelines. This thoughtful choice not just decreased my functional costs however also took advantage of their vast know-how, enhancing my capacity to make strategic choices. Collaborating with these specialists has actually resulted in a more effective workflow, promoting opportunities for enduring success and flexibility.